How does private healthcare cover affect your tax?

Private medical insurance is often a highly valued employee benefit for many people. Quick access to diagnosis and treatment can have benefits for both your team and for your business, as it can help get your employees back on their feet quickly.

Business healthcare cover can even be beneficial from a tax perspective. If you take out a business healthcare plan rather than a personal one, you could be eligible for tax relief. But don’t forget, when you offer private healthcare cover for employees as a benefit, it will have certain tax implications for you and your staff.

Private healthcare cover and tax FAQs

The questions and answers below are designed as a guide only and details may change at any time. For advice on specific cases, you should always speak to HM Revenue & Customs (HMRC), your accountant and tax adviser.

Is a Limited company eligible for tax relief on the business healthcare plan?

Yes. If you are buying healthcare cover through a Limited company, it is eligible for tax relief as business healthcare cover is classed as business expenditure. Therefore, it would benefit the business to pay for the private healthcare cover through the business bank account.

I own a small business that’s not a Limited Company (unincorporated). What would the tax implication be if I were to provide healthcare cover for my employees?

For unincorporated businesses, the cost of providing healthcare cover for employees is deductible when calculating taxable profits. That’s because it’s classed as a valid expense of the business and eligible for tax relief.

Do I need to report this to HMRC?

Yes. At the end of each tax year, you’ll need to complete and submit a P11D form for each employee, which states the benefits they’ve received.

You’ll also need to complete and submit a P11D(b) form and pay Class 1A National Insurance on the value of the benefit.

Am I eligible for tax relief on a private healthcare plan as the owner of the unincorporated business?

As the owner of the business a private healthcare plan for yourself would be classed as a personal expenditure. This means you won’t be able to claim it as a business expense.

Will employees need to pay tax on their private healthcare cover benefit?

When you provide healthcare cover to your employees, it’s considered a ‘benefit in kind’ and the employee will have to pay tax on it.

Is healthcare cover subject to Insurance Premium Tax (IPT)?

Yes it is. Healthcare cover is subject to IPT at the current rate.

How do I calculate the value of the benefit in kind for private healthcare cover?

The value of the benefit in kind is the employee’s private medical insurance premium.

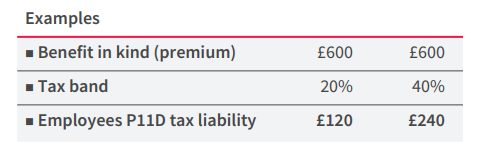

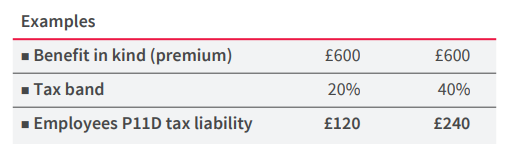

You will need to declare the employee’s full benefit in kind amount in the P11D. In this case it’s £600. The tax that your employee has to pay on their benefit is collected through the payroll process. And their tax code may change because they’re receiving a benefit on top of their earnings.

Guide to private medical insurance and P11D

The below information gives general guidance on how to handle details of private medical insurance when you complete a P11D expenses and benefits form. For advice on specific cases, you should always speak to HM Revenue & Customs (HMRC), your accountant or tax adviser.

What is a P11D?

A P11D is a form issued by HMRC. Its full title is the P11D Expenses and benefits form. At the end of each tax year, employers have to complete a P11D for every employee or director who:

- has been provided with expenses or benefits in addition to their salary.

- this does not include routine business expenses and benefits like travel and company car fuel.

Alternatively you can register with HMRC to voluntarily payroll this benefit in kind. The registration needs to be made prior to the start of the tax year.

Please note that HMRC have announced that with effect from April 2026 all taxable benefits, including private medical insurance, will need to be payrolled. Forms P11D will no longer be available. HMRC will share further detail in due course but in the meantime, we recommend you start to consider the impact of this change on your payroll processes at an early stage to ensure compliance with the new approach.

What is the difference between a P11D and a P11D(b)?

- A P11D is the end-of-year expenses and benefits form an employer needs to report for employees.

- A P11D(b) is used to report the amount of Class 1A National Insurance contributions due on expenses and benefits you've provided to employees.

Do you need to include private medical insurance on a P11D?

Yes. When you pay for an employee’s or director’s private medical insurance as part of their benefits package, HMRC regard it as a ‘benefit in kind’.

Each year, the P11D collects details of the cost of these benefits in kind. So you must include details of private medical insurance on the P11D.

If the employee or director pays for their own private medical insurance from their salary, it doesn’t need to be included on the P11D.

How do you know the cost you pay for each employee?

Your annual plan summary details the cost of private medical insurance for each employee on your plan.

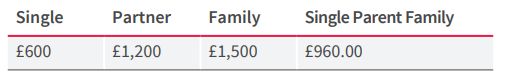

If, for example the cost for single cover is £600, partner cover is twice the amount for single cover. Family cover is calculated as 2.5 times single cover and single parent family cover is calculated as 1.6 times single cover. For those making contributions for family members, the amount contributed each year is deducted from the P11D value.

The multipliers shown are approximate. You should always check the single/partner/family and single parent family breakdown with your provider.

How do I calculate the value of the benefit in kind for private medical insurance (PMI)?

The value of the benefit in kind is the employee’s or director’s private medical insurance premium.

You need to declare the full benefit in kind amount in your P11D submission, i.e £600.

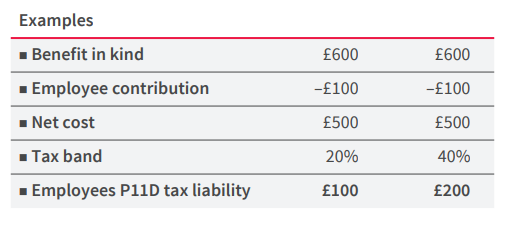

What happens if your employees contribute to the cost of their private medical insurance plan?

If the employee contributes to the cost of their private medical insurance, deduct the amount of their contribution from the total premium. And then work out the benefit in kind value in the same way.

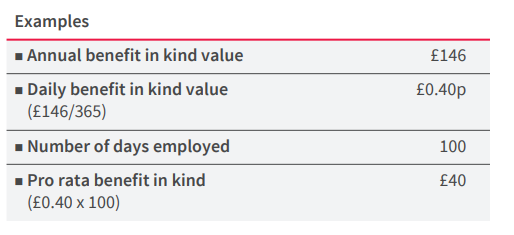

How do you work out the benefit in kind value if an employee joins or leaves part way through the plan year?

You need to work out the pro rata value of the benefit in kind – the cost for the time that they were an employee. Give this amount on the P11D.

What can PHC provide to help with your P11D calculations?

We can provide:

- Copies of your annual plan summary.

- Formula used to work out the costs for members and family members.

How will the values reported in the P11D effect my employees?

The P11D benefit in kind may result in your employees being sent a revised tax code to reflect any under or overpayment of tax.

Find out more

If you’d like to find out more about how private healthcare cover could benefit your business, and what is and isn’t covered by our plans, call us on: 01923 770 000

*Phone lines are open 8:30am-5:30pm Monday to Friday. We may record and/or monitor calls for quality assurance, training and as a record of our conversation.